Tips to Manage Finance During Lockdown (B.Com., BBA,MBA)

-

Click to open File(PDF/DOC/JPG/PNG)

Click to open File(PDF/DOC/JPG/PNG)

Like

0

#PRIYAPANDEY#2019807#B.COM(H)5SEM#JayotiVidyapeeth Womens University #TIPS TO MANAGE FINANACE DURING LOCKDOWN#

1.Check your direct debits to prevent unnecessary spending: Monitoring the money leaving your account each month is one of the easiest and most effective ways to reduce your spending. direct debits are leaving your account directly from your online banking. an app like smart-bill which will help you find and cancel unwanted subscriptions and track your monthly outgoings. This is especially useful if you have multiple bank accounts.

You can sometimes freeze payments on services you aren’t currently using, such as your gym membership. This may cost you a monthly fee, but it will be lower than your regular monthly payment. You can then restart the payment when everything goes back to normal.

If you’re missing your gym hit, take a look at how students are staying active in quarantine.

2.Use a money managing app: Online banking apps can be a major time saver when it comes to managing your money. They can help you budget, save and track your spending.

3.Pay your credit card on time: If you don’t repay your credit card in full by the end of the month, you will be charged interest on the value of purchases made on the card. You will also be charged a higher rate of interest if you withdraw cash on your credit card.If you decide to repay the minimum amount on your credit card repayments, you will still be charged compound interest on the remaining amount and it may negatively affect your credit score, making it harder to borrow money in the future.

If you do need to borrow money, avoid credit cards. Zero percent interest overdrafts are the way to go.

4. Use your overdraft as a buffer: If you have a student discount, you will usually be offered an interest free overdraft. This can be useful as a quick buffer if needed. Make sure to check your overdraft limit and if you have zero percent interest repayment. If you go over your overdraft limit, you will be charged heavily. If you can’t repay your overdraft before graduation, many graduate accounts also offer zero percent overdrafts, so see if you can switch to a graduate account which offers one.

5. Save money on your entertainment: Long gone are the days where you could pop out to the cinema and end the night with a few drinks in your local bar. Coronavirus-friendly entertainment is generally focused around your favorite streaming service, which although is generally less exciting, can be a very effective way to save money. Recreating your restaurant food is a fun way to be creative and learn some new culinary skills. Although, if you do decide to give in and get the occasional takeaway, you will generally spend less than you would on a restaurant meal, as you can save money on drinks.

-

Click to open File(PDF/DOC/JPG/PNG)

Click to open File(PDF/DOC/JPG/PNG)

Like

0

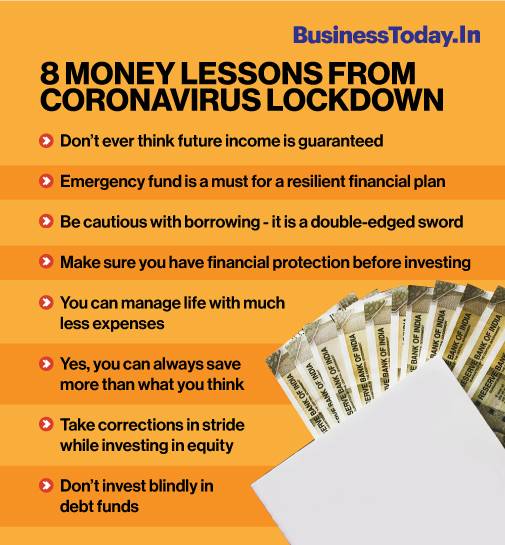

The shifting nature of the COVID-19 pandemic has left us praying for normalcy to return. Anxiety and fear have reached the recesses of our collective psyche. Even thinking about tomorrow seems futile in the face of contagion. And with the economic slowdown and the financial crisis testing our survival, the world paints a dismal picture today.

However, this too shall pass! But until it does, how does one prepare for the future? The answer lies in the way we manage our finances – and availing a personal loan is one such solution.

-

Click to open File(PDF/DOC/JPG/PNG)

Click to open File(PDF/DOC/JPG/PNG)

Like

0

1. Check your direct debits to prevent unnecessary spending

2.Use a money managing app

3.Pay your credit card on time

4. Use your overdraft as a buffer

5. Save money on your entertainment

6. Be smart with your supermarket shopping

7. Make an emergency budget

8. Check to see if you’re eligible for a larger student loan or a grant

#sonaligaur #21222 #MBA(HRM)1STSEM #jayotividyapeethwomensuniversity #tipstomanagefinanceduringlockdown

-

Click to open File(PDF/DOC/JPG/PNG)

Click to open File(PDF/DOC/JPG/PNG)

Like

0

The shifting nature of the COVID-19 pandemic has left us praying for normalcy to return. Anxiety and fear have reached the recesses of our collective psyche. Even thinking about tomorrow seems futile in the face of contagion. And with the economic slowdown and the financial crisis testing our survival, the world paints a dismal picture today.

-

Click to open File(PDF/DOC/JPG/PNG)

Click to open File(PDF/DOC/JPG/PNG)

Like

0

The shifting nature of the COVID-19 pandemic has left us praying for normalcy to return. Anxiety and fear have reached the recesses of our collective psyche. Even thinking about tomorrow seems futile in the face of contagion. And with the economic slowdown and the financial crisis testing our survival, the world paints a dismal picture today.

However, this too shall pass! But until it does, how does one prepare for the future? The answer lies in the way we manage our finances – and availing a personal loan is one such solution.The shifting nature of the COVID-19 pandemic has left us praying for normalcy to return. Anxiety and fear have reached the recesses of our collective psyche. Even thinking about tomorrow seems futile in the face of contagion. And with the economic slowdown and the financial crisis testing our survival, the world paints a dismal picture today.

However, this too shall pass! But until it does, how does one prepare for the future? The answer lies in the way we manage our finances – and availing a personal loan is one such solution.